DMI shows that the buyers of the token Pi are always under control, but the difference has become more and more decreased between +di and -di, indicating weakening of bull pressure. In parallel, RSI pi was cooled on the surface of the extreme above the ambitional and its lines EMA indicate a possible conversion of the trend, threatening the bull perspective of crypto in fashion.

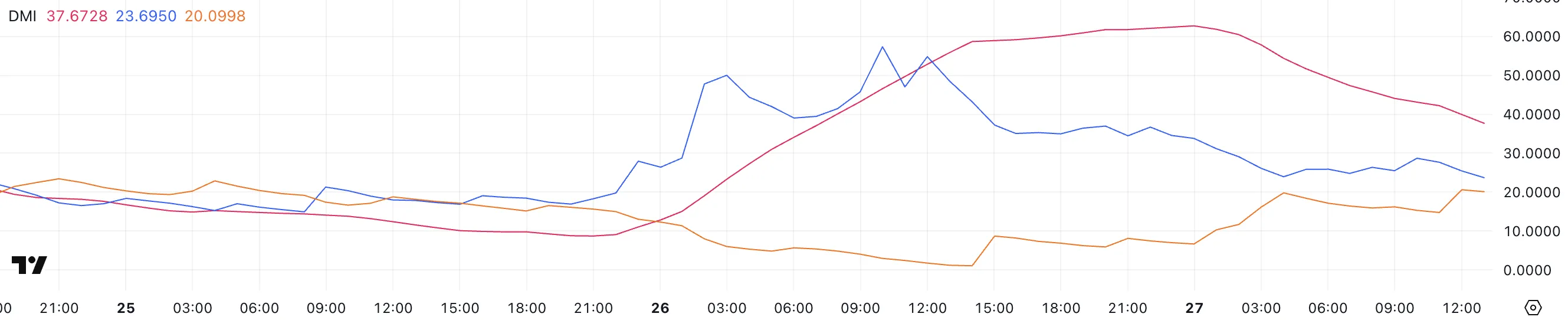

The PI DMI indicator shows a potential reversal of the trend

The DMI Pi Pi shows that its ADX is currently 37.6, after climbing 9 to 62.7 between yesterday, Thursday, February 27 and today on Friday, February 28. We remind you that the average directional index (ADX) measures the power of trend without indicating its direction.

This indicator varies from 0 to 100, values above 25 indicate a strong trend, while values below 20 indicate a low or clear market.

+Di de Pi is 23.6, compared to its value of 57 yesterday, suggesting that it weakens the bull pressure. As for its part, -Di passed from 1 to 20, indicating an increase in the reduction of the feeling for crypto pi.

Despite this change, +di remains above -Di, and therefore confirms that the lesson Pi is still in the ascending trend. However, the increasingly limited gap between directional indicators suggests that the ascending trend loses its strength. So if +di continues to reduce and passes under -Di, it could point out the beginning of the conversion of the trend.

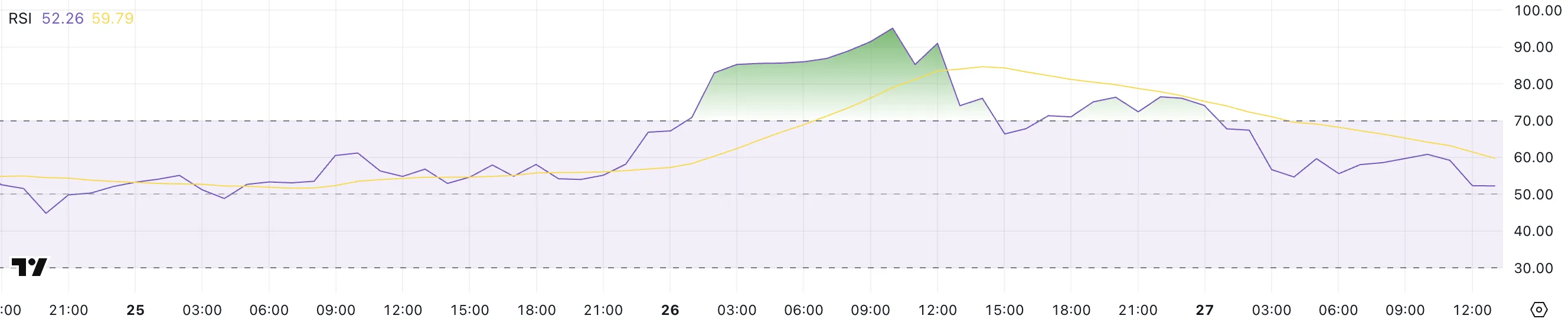

RSI nets Pi will leave the Surahat area

RSI, another important indicator of PI, is currently at 52.2, after reaching an extreme summit of 95 yesterday and was maintained over 70 for several hours 26 February. As a reminder is the relative force index (RSI) of the oscillator of momentum, ie the momentum that measures the speed and change of the course movements and differs from 0 to 100.

The values greater than 70 indicate the conditions of Suurahat, indicating that the assets could be overvalued and ready to withdraw, while the values of less than 30 indicate the conditions of the occurrence, signaling the jump.

Finally, RSI between 30 and 70 is generally considered neutral, without a strong direction.

Pi RSI, which dropped to 52.2 after staying over 70 years and came out to 95, suggests that intense shopping pressure has cooled for this crypt. This decline reflects the loss of bull momentum and may indicate the beginning of the consolidation phase at the cost of the PI.

The brutal decline in extreme levels of overflow also suggests that profits are occurring, increasing the probability of temporary course correction.

Knowing that RSI is now in a neutral zone, the movement of the next course will largely depend on the return of the interest of the purchase or vice versa on the accumulation of sales pressure.

Pi Risks 68 % Correction

Ema lines remain up, short -term lines located above the lines in the long run indicate that the upper tendencies always intact. However, the recent movement of the course suggests that this ascending trend could lose its dynamics, which is also indicated by the last DMI and RSI values.

Pi is currently one of the most promoted parts on the crypto market and continues to Regularly subtitles. Recently, the CEO of Moonrock Capital, Simon Dedic, is reportedly trading in Wash trading PI Network. Previously, the room climbed after receiving companies in Florida.

However, weakening of pressure in the purchase and the increase in bear feeling suggests a potential change in the positive feeling of the last days. If the EMA line continues to converge, it could point out the immediate inversion of the tendency, threatening the ascending perspectives of the token.

However, if it is possible to regain the power of its ascending trend, it could test levels over $ 3 for the first time and potentially reach $ 3.5.

Conversely, if the trend is perverted, the lesson could test the support at $ 1.69. If this level is lost, then it could continue to fall to $ 1.42. If this support did not hold even the PI network, it could finally drop to $ 0.8, which meant a massive correction of 68 % of its course.

Morality of History: Trendy crypto does not know half measurements.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.